You’ve decided to sell your business—now what?

Selling a business can feel overwhelming, especially if you’ve never been through this process before. Between the timing of the sale and the logistics, there are lots of factors to take into consideration before you proceed.

First, you need to understand that it’s perfectly OK to sell your business. Many small business owners struggle with this concept, especially if it’s a company they’ve built from scratch.

Entrepreneurs sell their businesses for a wide range of reasons. Whether you’re ready for retirement, feeling overworked, or just ready to move on to the next chapter of your life, selling your business can be extremely rewarding.

If you take the right approach, the profits can fund your next venture or give you the financial freedom you’ve always dreamed about.

As someone who has bought and sold multiple businesses throughout my career, I know what it takes to sell your business the right way. I’ve taken a complicated process and simplified it to just five easy steps.

Step #1: Determine Your Business Valuation

Most entrepreneurs think they have an idea about what their business is worth. But in many cases, the number in their minds is way off from its actual value.

So before you list the sale price too high or too low, it’s best to bring in a valuation expert. A third-party valuation will provide you with a realistic estimate of the company’s worth. For a fixed amount (usually a few thousand dollars), a qualified appraiser can determine the business’s worth with a detailed report and documentation.

The report can ultimately help bring credibility to your asking price if prospective buyers question the amount. At the very least, the valuation will give you a rough estimate of what you can expect.

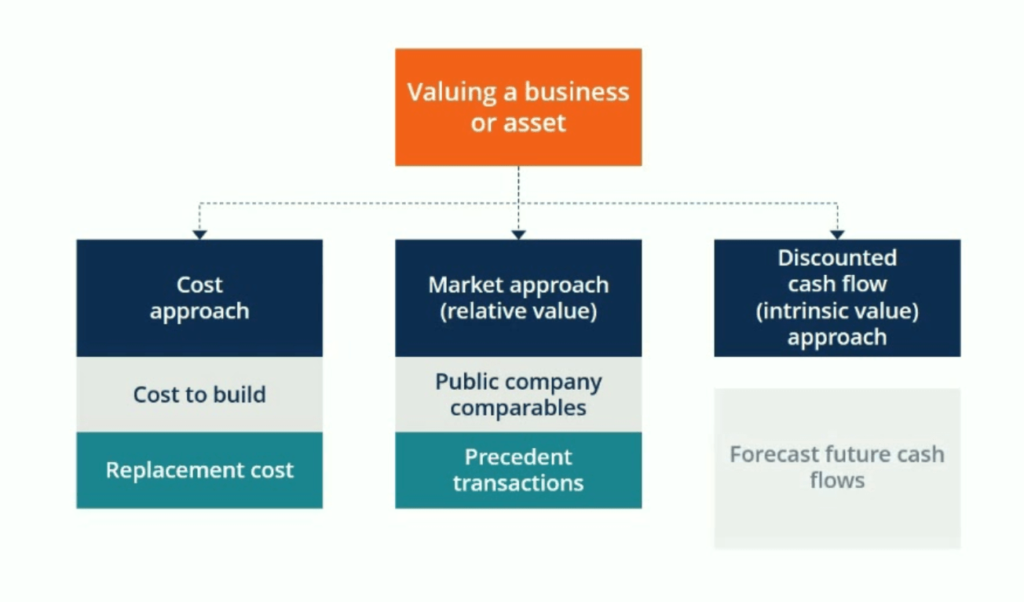

If you don’t want to hire an appraiser, you could always try to figure out the value on your own. Generally speaking, there are three main ways to value a business—cost approach, market approach, or the intrinsic value approach.

The third method, also known as the discounted cash flow approach, is the easiest to do. Most companies are usually worth anywhere from three to six times the current cash flow.

With that said, there are lots of other factors to take into consideration here. Industry trends, business debt, assets, and similar companies for sale are just a few examples to consider.

Whether you estimate the value on your own or bring in a third-party appraiser, the valuation may not end up being the final sale price.

At the end of the day, the business is only worth what someone is willing to pay for it. If you’re unhappy with the valuation, it might not be time to sell your business quite yet.

Think of it like selling a home. Your real estate agent could tell you what the house is worth, but the property could sit on the market for months at that list price. You might have to put some money into the house to get the maximum value. The same analogy can be applied to selling your business.

Step #2: Get Your Financials in Order

Once you’ve determined the company’s value, it’s time to organize your financials. For some of you, this will be much easier than others.

Selling a business puts lots of eyes on your financial records. Prospective buyers, lawyers, accountants, third-party valuation firms, brokers, specialists, and other people will be combing through your statements. To ensure everything goes smoothly, your bookkeeping must be immaculate.

In most cases, you’ll need to provide at least the last three years of tax returns, as well as accurate financial statements (balance sheet, income statement, cash flow statement).

Any mistakes or disorganization in these records could be a red flag for potential buyers. Inconsistencies in your books could raise other questions, even if it was just an honest mistake.

Am I being misled? Are these numbers trying to cover something up? Can I believe everything else I’ve been told about the business? These are the types of thoughts that will go through the mind of a buyer if errors are found in your financials.

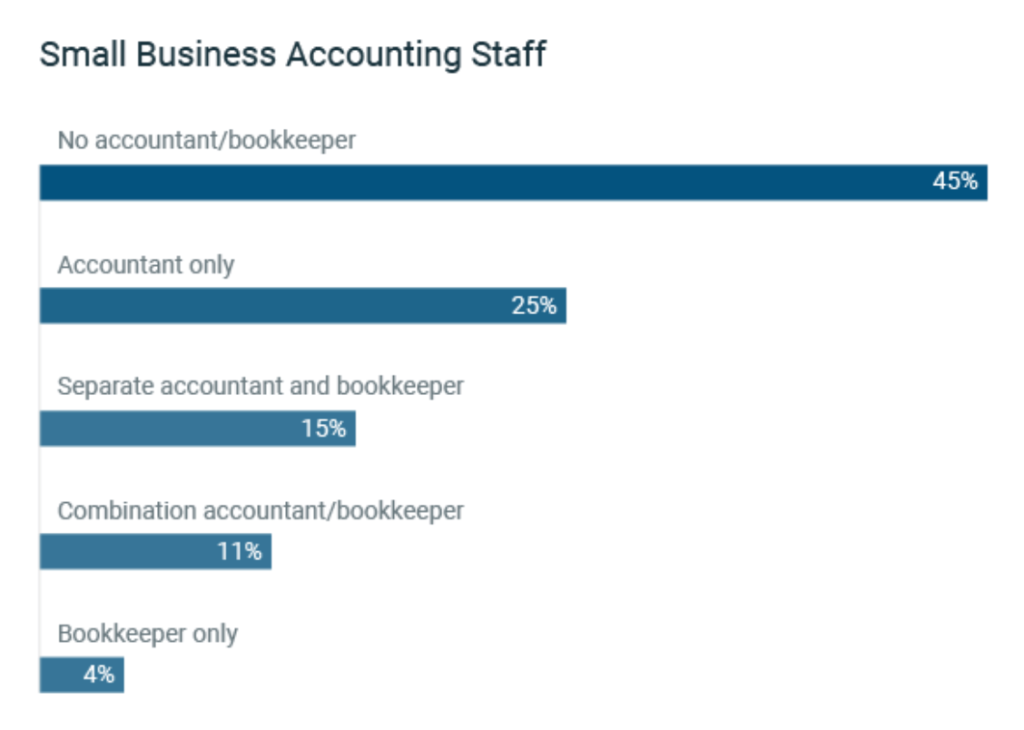

The vast majority of small businesses don’t have an accountant or a bookkeeper.

If you fall into that category, I strongly recommend hiring an accounting expert to clean up your books before you list the business for sale. This will make your life much easier down the road.

Step #3: Hire a Business Broker

There are basically two options to consider when selling a business—sell it on your own or use a broker.

You could potentially sell the company on your own if you’re selling to a family member or someone trustworthy in your life. This will help you save some money on brokerage fees.

But for the vast majority of circumstances, using a broker will be your best bet.

Will there be some extra fees associated with this method? Absolutely. But a broker can help you get the best possible price and sell your business faster than you could do on your own. Remember, brokers work on commission. So it’s in their best interest as well to sell the company for maximum value.

The broker will typically form their own valuation of the business. Compare this to estimate you got back in step #1. While the two numbers probably won’t be exact, they should be relatively close.

If there’s a drastic difference between the broker’s estimate and valuation given by the appraiser, you might want to get a third opinion to see which one is more accurate.

Your broker has lots of experience selling businesses, which is extremely valuable. Other common duties of a broker include:

- Finding the best buyers

- Marketing the sale

- Provide confidentiality

- Getting the deal financed

- Assist with negotiations

- Manage due diligence

Business Broker Options

Here are recommendations on best business brokers to sell your business:

- Bizbuysell.com – best for businesses with Under $300,000

- Businessexits.com – best for businesses with over $300,000 to $10m in yearly profit

- HL.com – best for businesses with over $10m in yearly profit

So how much will this cost you? Pricing for a business broker usually depends on how much money your business makes.

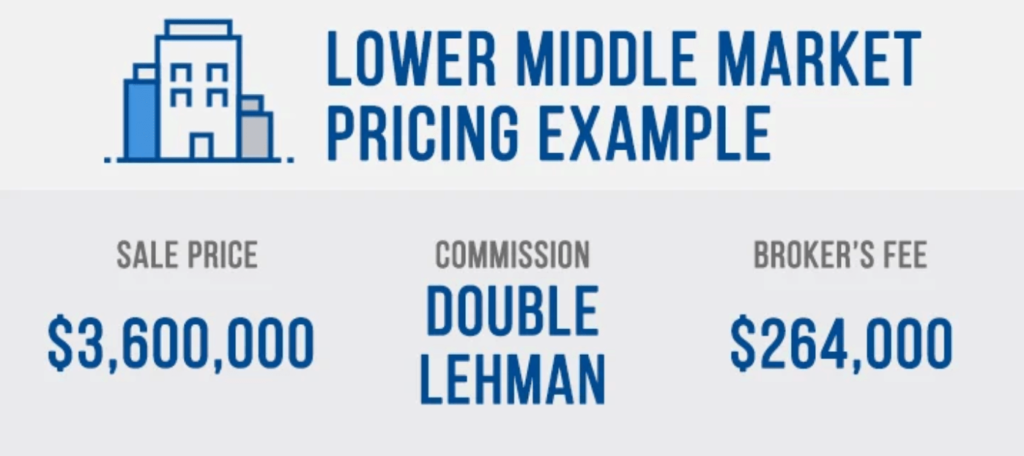

The general rule of thumb is this; the higher your revenue, the lower the broker’s commission fee.

A business with up to $1 million in revenue will typically pay a 10-12% brokerage fee, whereas businesses with $25+ million typically pay in the 2.5-4.5% commission range. For companies in the middle, it’s common for brokers to use the Double Lehman commission model, as opposed to a flat percentage.

It’s important to understand the broker’s commission model from the beginning. So ask questions if you’re unsure. Some brokers might even charge you a retainer, but you can probably avoid that by offering a minimum commission amount.

Step #4: Find Pre-Qualified Buyers

There are two key words to this step; pre-qualified and buyers (plural).

You’ll definitely want to field multiple offers for several reasons. For starters, not every offer will be legitimate. Selling your business requires you to disclose sensitive information about your organization. This could be worth a fortune to your competitors.

It’s possible that a competitor, or someone acting on behalf of a competitor, could make an offer just to review your financials. So don’t hand over that information to just anyone.

Most business transactions are backed by a third-party loan from the SBA. In some cases, banks require sellers to provide some of the financing as well. So don’t get too excited over the first offer that comes in and assume the company will be sold.

On average, it takes six to eight months to sell a business.

In addition to the broker, you could always bring in a sales expert to help speed up this process and pre-qualify buyers.

Buyers can typically be segmented into three main categories:

- Individual buyers

- Strategic buyers

- Private equity groups

The type of buyer making an offer plays a role in how long it takes to process the transaction. For example, an individual buyer will likely need an SBA-backed loan, which can take up to 90 days for approval, whereas a private equity group could finance the purchase on its own.

Don’t rush to accept an offer right away, either. You can always use one offer to leverage another, which will give you the maximum value for your business.

Step #5: Finalize Legal Documents and Contracts

Once you’ve found a qualified buyer and accepted an offer, it’s time to finalize the deal.

This is where things can get a little bit messy and confusing. So you’ll definitely want to have your lawyer handle the vast majority of this stage.

Some of the standard legal documents and contracts associated with a business sale include:

- Purchase agreement

- Asset listings

- Noncompete agreements

- Guidelines for website use and domain name

- Bill of sale

- Security agreement

You could potentially draft a purchase agreement and contract on your own, but I would strongly advise against that. There’s a good chance that you’ll miss vital information, and you could be left vulnerable to unforeseen circumstances. These contracts can be upwards of 25-50+ pages long.

If your current lawyer is not an expert with contract law, they should be able to refer a colleague.

Once everything is in order, it’s just a matter of crossing the T’s, dotting the I’s, followed by lots of signatures and initials.

Tips and Best Practices For Selling Your Business

While the process of selling your business can be simplified to just the five steps listed above, there are certain things you need to do along the way.

Follow these tips and best practices to make sure the sale goes smoothly. This will also ensure you get the maximum value for your business.

Boost Your Sales

As I said before, selling your business takes time. You can’t expect to list it today and get an offer tomorrow.

I’ve seen so many business owners focus so much effort on selling their company, that they neglect the business itself while they’re still in charge. You must continue coming to work every day and put all of your efforts into increasing sales.

Strong sales will ultimately increase the valuation of your business and make it more appealing to buyers. On the flip side, a drop or plateau in sales could be a huge red flag for prospective owners.

That’s why it’s important for you to surround yourself with people who can help you through this process. Let your broker, lawyer, and accountant handle their respective responsibilities. This will give you more time to prioritize sales.

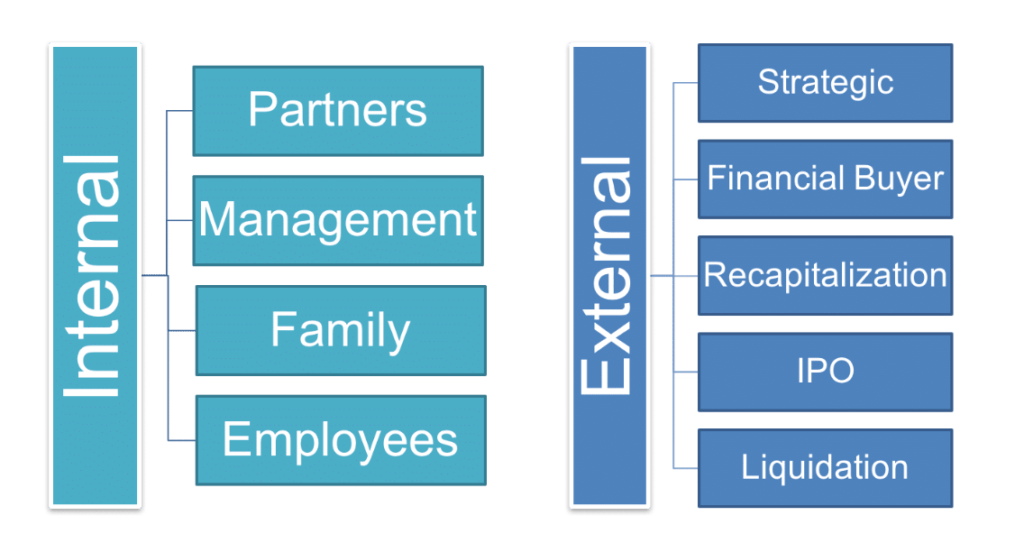

Develop an Exit Strategy

Every business owner needs to have an exit strategy. The best exit strategies are developed long before the decision to sell your business occurs.

So hopefully, this is something you’ve been planning for a while; a proper exit strategy takes time to develop. For those of you who don’t currently have an exit strategy, it’s not too late to create one. But with that said, this might not be the best time to sell your business.

The last thing you want is to be in a position where you feel forced to sell your company. In those circumstances, it’s unlikely that you’ll be able to sell for maximum value.

Things come up. So have a contingency plan in place for a wide range of possible exit strategies.

What will you do if a big box store opens nearby? How will you proceed if age or illness becomes a factor in your life? What if your children don’t want to take over the company? These are just a few examples of situations that could arise.

When the day comes that you decide to sell, you’ll already be prepared with an exit strategy.

Be Rational

Selling a business can be very emotional. This is especially true for family businesses, small businesses, or something that you’ve built on your own from scratch.

Most business owners have a great sense of pride for what they’ve accomplished. Blood, sweat, tears, and sleepless nights are all things that entrepreneurs have in common.

With that said, it’s crucial that you keep your emotions out of the deal. Getting emotional can cloud your thoughts and decisions.

Prospective buyers don’t care how many hours you’ve worked per week for the last decade. All they care about is the bottom line. If you think an offer is too low or unfair, you can always decline.

In some cases, a competitor might make a legitimate and fair offer, with the full intention of buying. Don’t let an old rivalry prevent the deal from going through.

Get Paid Up Front

Make sure the terms of your deal require an upfront payment. Some buyers might make you an enticing offer, but don’t have the funding to pay you now.

Getting paid over time might not sound like a big deal, but this arrangement could pose some challenges for you down the road. You could end up in a situation where you’re not getting paid to the terms that you agreed. If that happens, any legal recourse would just be an added expense to your side.

Furthermore, the new owner could run out of money to keep the business alive. If that happens, there may not be any money left for you if the company goes under.

Let’s say you have two serious offers on the table. One is for a higher amount but involves a ten year financing period. The second offer is less but pays you upfront. I’d strongly recommend the latter.

Conclusion

Ready to sell your business? Don’t overcomplicate things; the entire process can be broken down into just five simple steps.

With that said, selling a business takes time. Have realistic expectations in terms of the price and timeframe.

In some cases, you might ultimately decide to postpone the sale until you can increase revenues and get your financials organized. If your company is doing well and generating high profits, it’s much more appealing to potential buyers.

Use this guide as a reference to walk you through the process. Make sure to follow the tips and best practices that I’ve outlined above to get the maximum purchase value for your company.

from Quick Sprout https://ift.tt/2O9muOF

No comments:

Post a Comment